Smart Qarza App for Entrepreneurs Registering Companies

Welcome to 2025, where entrepreneurs in Pakistan are looking for smart, digital tools to launch their ventures. The Smart Qarza App is making waves, especially for those registering companies and needing early capital.

In this post, we’ll walk you through what it is, how it works, and how you can leverage it to boost your business journey.

What Is the Smart Qarza App?

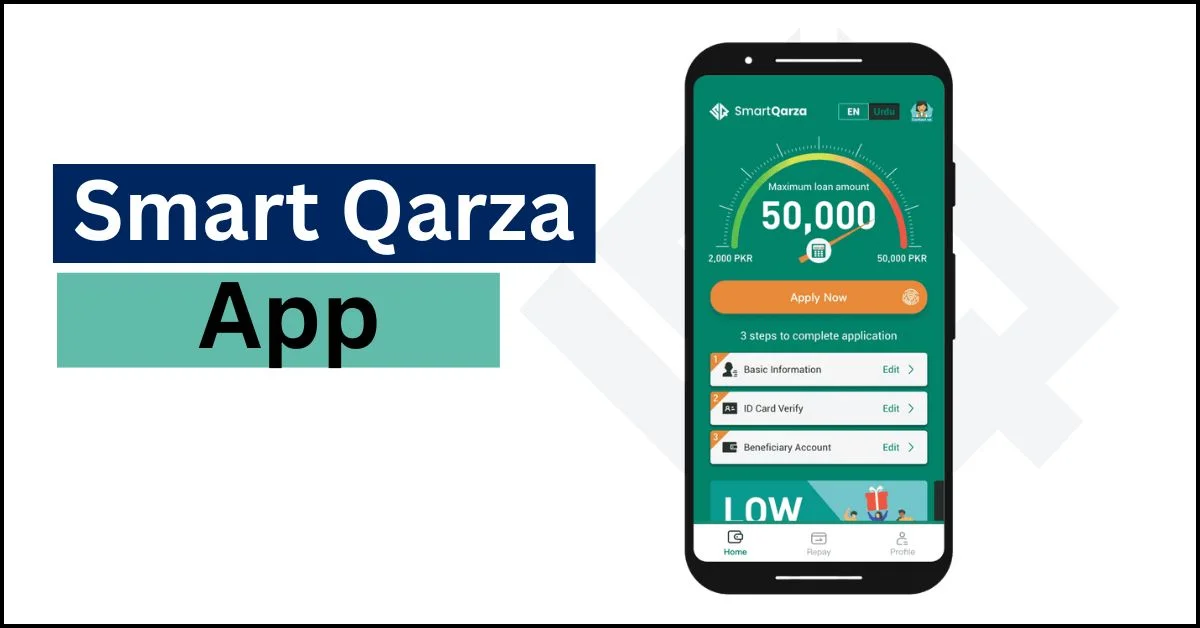

Smart Qarza is a nano‑loan app that’s officially recognized by SECP, making it one of the few regulated digital lending platforms in Pakistan.

Unlike predatory lending schemes, Smart Qarza aims to provide quick, small loans based on your business credentials. Because it’s SECP-licensed, entrepreneurs can trust it more than random unverified apps.

It’s especially relevant for those in the company registration phase — it can bridge the funding gap when you’re still assembling capital, paying for registration fees, or marketing your startup.

Key Features at a Glance

| Feature | Benefit for Entrepreneurs |

| Fast loan disbursement | Helps with immediate cash flow |

| Minimal documentation | Easier for new business owners |

| Regulated by SECP | Less risk of scam or fraud |

| Mobile interface | Apply from anywhere, anytime |

These qualities make Smart Qarza a compelling option for founders who need capital while also completing the legal work of registering their companies.

How Smart Qarza Helps with Company Registration

When you register a company in Pakistan, you face costs: SECP fees, legal documentation, office rent, etc. That’s where Smart Qarza can step in.

- Covering registration costs

Use your loan to pay for name reservation, submission of MOA/AOA, and SECP filing costs. - Marketing & branding

After registration, you’ll need a website, social media setup, and perhaps initial ads. - Operational buffer

Handle phone/office rent, utilities, or staff while your business starts generating revenue.

By linking Smart Qarza with your registration plan, you create a financial safety net. Just ensure you repay responsibly.

How to Use Smart Qarza in Simple Steps

Here’s how you can get started with Smart Qarza, especially if you’re in the process of registering a company:

- Download the app

Install only from trusted sources. Do not trust random APKs. - Register & verify identity (KYC)

Provide CNIC, selfies, bank/wallet details, etc. - Apply for a loan

Enter the amount you need for registration or early business costs. - Disbursement & repayment

Funds go to your wallet or bank. Make sure you repay on time to keep your credit standing clean.

Many founders pair this with steps from company registration in Pakistan to get guidance on how to properly register their startup. Linking your funding and registration efforts is smart alignment.

Things to Keep in Mind (Risks & Best Practices)

Smart Qarza has promise, but like any financial tool, you should tread wisely.

A misstep in loan use can become a trap. Stay strategic, pay on time, and don’t overspend.

Why Smart Qarza Is a Game Changer in 2025

In 2025, digital startups are booming in Pakistan—but many promising ideas die due to a lack of early capital. Smart Qarza fills that gap. Its regulated nature, ease of use, and targeted support for entrepreneurs make it a standout tool.

Because it supports founders during the registration phase, it is more than a loan app—it’s part of the business launch ecosystem. Smart Qarza is not perfect, but if used smartly and cautiously, it can power your startup journey.

Final Thoughts

If you’re an entrepreneur registering a company in Pakistan, the Smart Qarza App can be an empowering financial companion. Use it for registration costs, early operations, or marketing. But always stay cautious, verify everything, and don’t overextend yourself.

Pair your use of Smart Qarza with resources from Company Registration Pakistan to ensure you’re legally and financially secure.

Go ahead—download, verify, and use Smart Qarza wisely. Your dream company deserves a smart start!